Category: Passive Real Estate Investing

-

Beyond Wall Street: Building Wealth with Real Estate Syndications

You’ve built a solid portfolio. You’re maxing out your 401(k), watching the stock market swing, and wondering: Is there a smarter, more stable way to grow my wealth? There is—and it’s called real estate syndication. At NC Capital Group, we make it possible for busy professionals to invest in large-scale real estate without the headaches…

-

Multifamily Investing: A Hedge Against Volatility and Inflation

When markets swing and prices rise, savvy investors turn to assets that can weather the storm. Multifamily housing has become a cornerstone of resilient portfolios—and for good reason. It combines reliable cash flow, natural appreciation, and long-term demand. At NC Capital Group, we focus on multifamily properties in North Carolina for an added edge: population…

-

Why Neighborhood Shopping Centers Are a Smart Play in 2025

In a world of shifting consumer habits and market volatility, some investment opportunities are quietly standing strong—and neighborhood shopping centers are among them. At NC Capital Group, we believe that investing in neighborhood shopping centers isn’t just smart—it’s strategic. Here’s why 2025 is the right time to look local: 1. Convenience Is King Post-pandemic lifestyles…

-

When Diversification Gets Real

There was a stretch a few years ago when I stopped checking my retirement accounts. Not for strategic reasons, mind you—I just couldn’t stomach watching red numbers bleed across the screen. The market was throwing a tantrum, and my carefully balanced mix of stocks and funds was looking less like a financial plan and more…

-

How Real Estate Protects Your Buying Power in Inflationary Times

Even for high-earning professionals, inflation has become harder to ignore.The cost of everything — from groceries and healthcare to housing and travel — has risen meaningfully in recent years. And while salaries have kept pace for some, the real value of money is under pressure. If you’re planning for long-term financial stability, it’s worth examining…

-

How High-Earning Professionals Can Build Wealth Beyond Wall Street

If you’re a high-earning professional, you already know how to generate income. But income alone isn’t wealth. Wealth is what happens when smart capital allocation meets time — and increasingly, building durable wealth means looking beyond Wall Street. Let’s talk about the missing third pillar. The Traditional Portfolio: Good, But Not Good Enough For decades,…

-

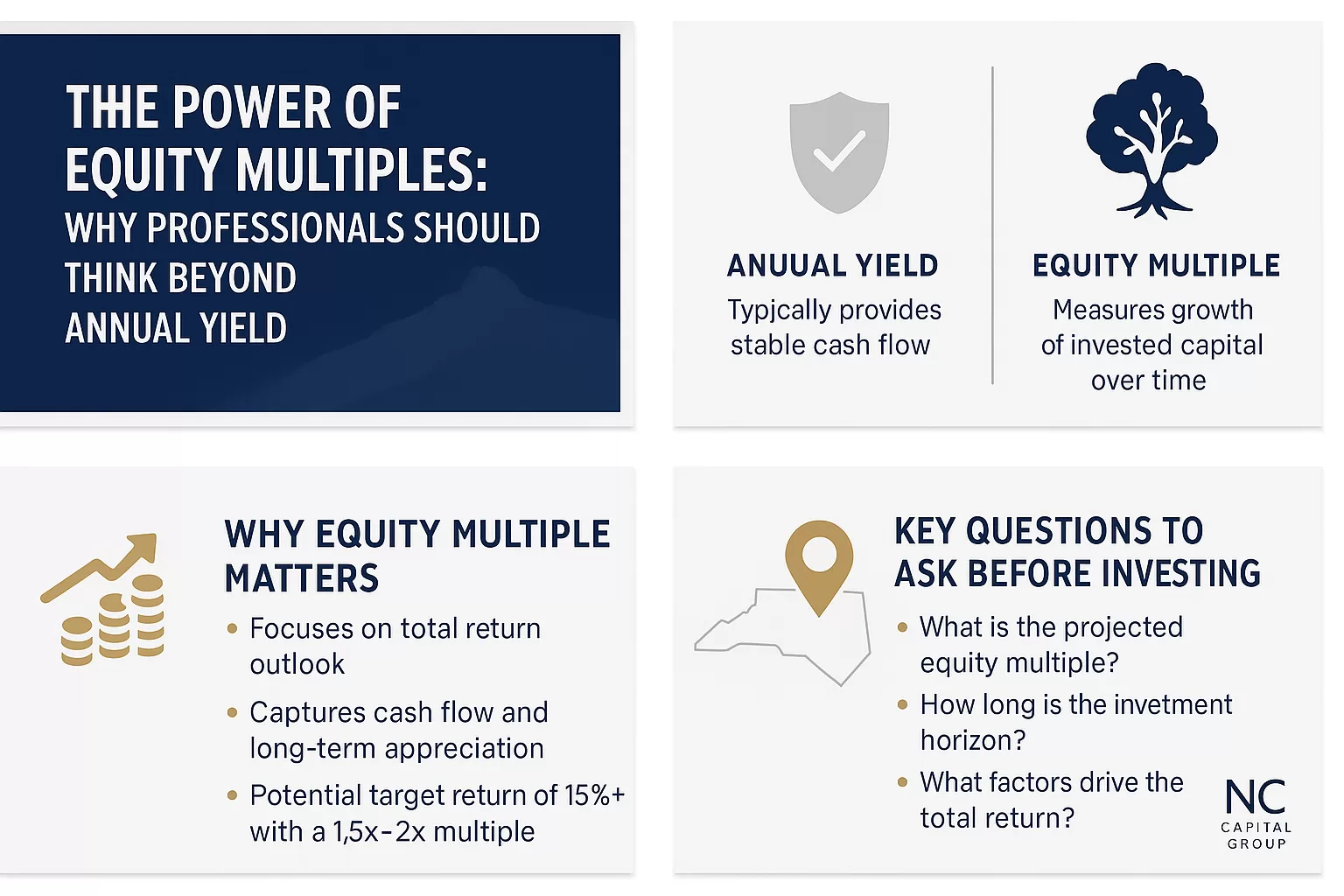

The Power of Equity Multiples: Why Professionals Should Think Beyond Annual Yield

When most investors look at potential investments, their first question tends to be, “What’s the yield?” It’s a fair starting point — after all, yield represents immediate cash in your pocket. But if you’re a high-earning professional building wealth over the long term, focusing only on annual yield is like judging a car solely by…