Category: Passive Real Estate Investing

-

The Case for Class B Multifamily in 2026: Slowing Supply, Stable Demand, and Resilient Cash Flow

As investors look ahead in 2026, a few real estate trends stand out clearly in the data. You don’t need deep real estate expertise to understand them. Three fundamentals matter most: Taken together, these factors help explain why Class B multifamily is often viewed as a durable option for passive real estate investors. 1. New…

-

Passive Real Estate Investing Explained: LP Ownership, Cash Flow, and Exit

For many professionals, traditional portfolios dominated by stocks and bonds eventually feel incomplete. Market volatility, correlation risk, and limited income control tend to surface at exactly the wrong stage of life—when predictability matters more than headlines. Passive real estate investing addresses that gap by offering direct ownership of income-producing assets without the operational burden of…

-

The Pros and Cons of Passive Real Estate Investing for Long-Term Wealth Builders

As investors progress in their careers and accumulate capital, many begin to question whether a traditional portfolio of stocks and bonds is sufficient on its own. Volatility, sequence-of-returns risk, and tax inefficiency often become more noticeable—especially for high earners and professionals approaching retirement. This is typically where passive real estate investing enters the conversation. Not…

-

What Is a General Partner in Passive Real Estate Investing?

When you invest passively in a real estate deal, someone has to do the actual work. That role belongs to the General Partner (GP). A General Partner is the party responsible for finding, acquiring, financing, operating, and ultimately exiting a real estate investment. Limited Partners provide the capital, General Partners provide the expertise, execution, and…

-

Why North Carolina Is a Strong Market for Passive Real Estate Investing

Passive real estate investing works best when long-term fundamentals do the heavy lifting. Markets with sustained population growth, diversified job creation, and a stable regulatory environment tend to reward patient capital—especially when investments are professionally managed and structured for cash flow. North Carolina consistently checks those boxes. This is not a story about hype or…

-

What Is a Limited Partner? A Simple Guide to Passive Real Estate Ownership

For many professionals, real estate is attractive—but the reality of managing it is not. Tenants, maintenance calls, leasing decisions, and constant oversight don’t fit well with a full-time career or an active retirement plan. That’s where being a Limited Partner (LP) comes in. A Limited Partner is a way to own real estate passively, alongside…

-

Why Smart Passive Investors Review Real Estate Offerings Regularly (Even When They Don’t Invest)

In private real estate, the best investors don’t invest often. They invest selectively. That selectivity isn’t accidental. It’s built over time by consistently reviewing real estate offerings—many of which they ultimately pass on. For experienced passive investors, reviewing offerings isn’t a prelude to action. It’s part of the discipline. And it’s one of the most…

-

Cash Flow, Growth, or Both? How to Choose the Right Real Estate Asset Class

Real estate is often described as a single asset class. In practice, it’s anything but. Multifamily housing, grocery-anchored retail, office, specialty assets—each behaves differently, carries different risks, and serves different investor goals. Choosing the right real estate asset class isn’t about finding the best investment. It’s about finding the right fit for what you’re trying…

-

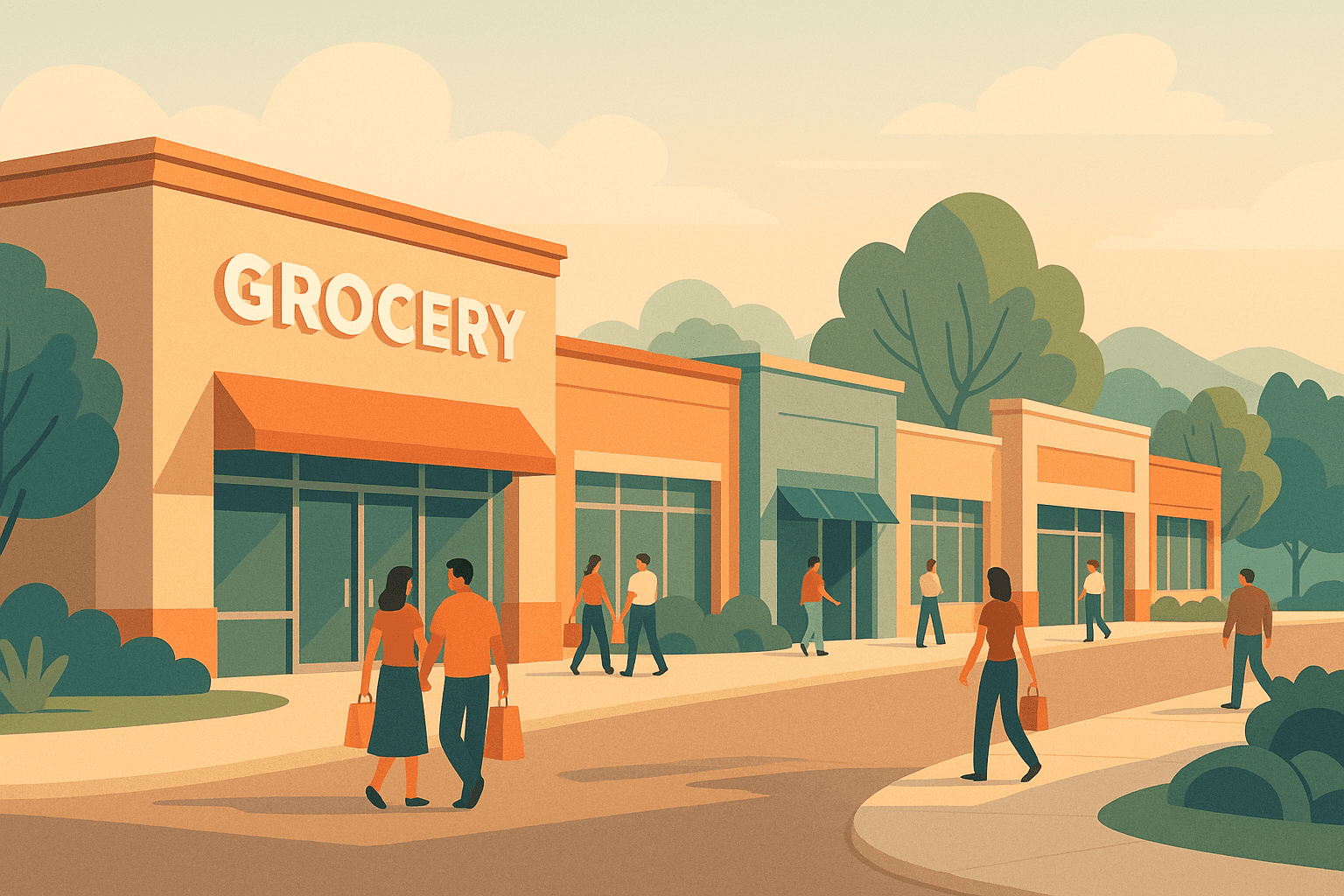

Why Neighborhood Shopping Centers Belong in a Modern Investment Portfolio

Neighborhood shopping centers are one of the most reliable and misunderstood real estate assets. They don’t behave like malls, they don’t depend on fashion trends, and they aren’t threatened by e-commerce in the same way other retail categories are. Instead, they exist for one purpose: serving everyday needs. For investors who want stable income, inflation…