Global real estate leader CBRE recently released its 2025 Scoring Tech Talent report, an annual analysis that ranks 50 major North American markets by their ability to attract and grow technology talent. Now in its 13th year, the study evaluates each metro area across 13 metrics—including labor pool size, educational attainment, operating costs, and innovation activity.

The purpose is straightforward: to help companies and investors understand where technology-driven growth is likely to occur. Tech companies follow talent, and talent drives both office demand and local spending power, shaping the housing and retail landscapes in each market.

Why Tech Is an Economic Engine

Technology remains one of the most powerful economic multipliers in modern economies. High-wage tech workers contribute to strong household income levels, population inflows, and consumer spending—three fundamental forces behind demand for housing and neighborhood retail centers.

As artificial intelligence, data science, and cybersecurity continue to expand, tech employment fuels the creation of secondary and tertiary jobs in education, healthcare, logistics, and services. These workers, in turn, need attainable homes and convenient access to grocery, dining, and everyday shopping.

For real estate investors, this means that markets with sustained tech-sector growth often experience resilient rent performance and lower volatility—especially in the multifamily and grocery-anchored retail segments that NC Capital Group focuses on.

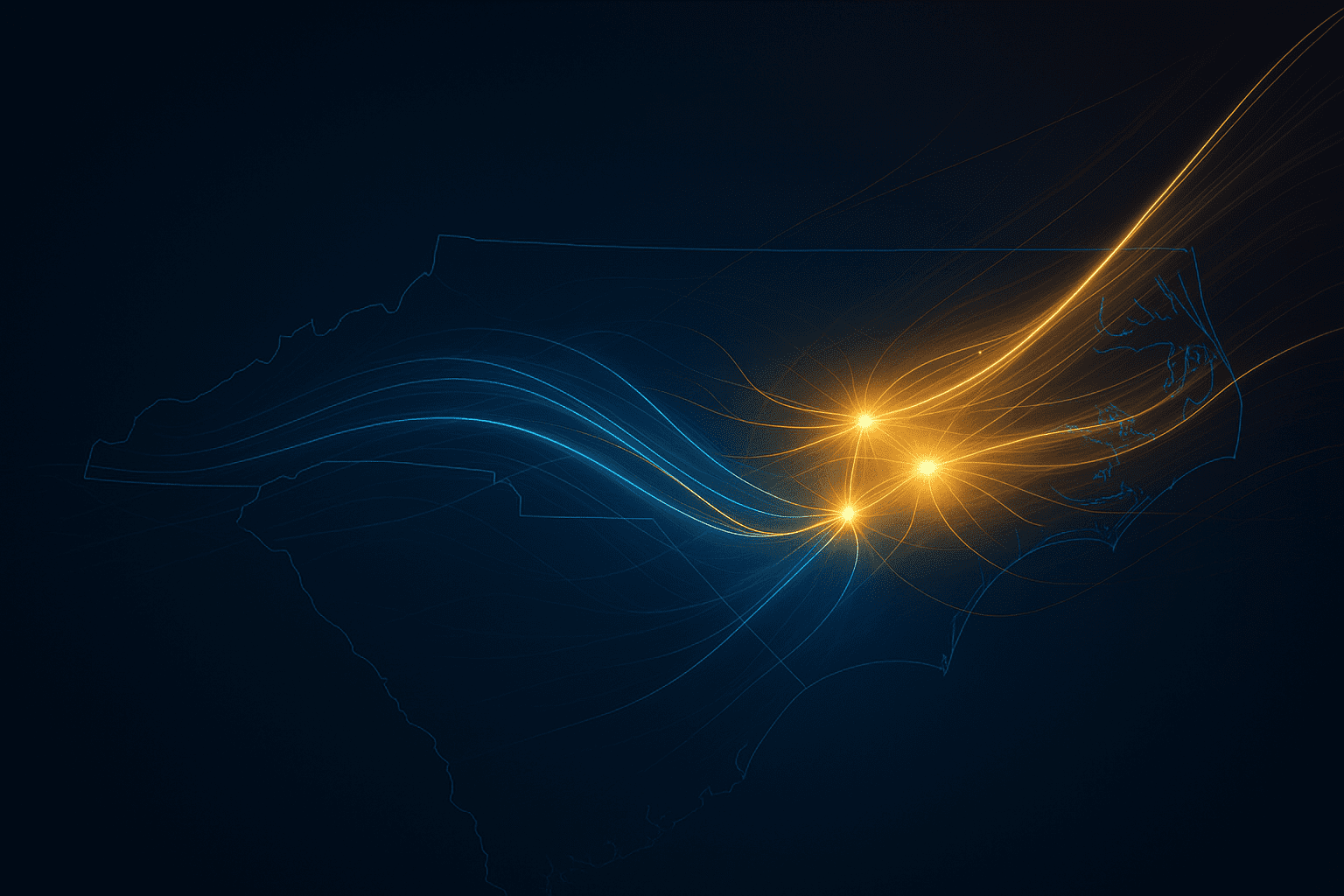

Raleigh-Durham’s Tech Momentum

CBRE’s 2025 report highlights Raleigh-Durham as one of the top-performing U.S. markets for tech talent growth, moving up in the rankings again this year. The metro’s advantages are well known:

- Research Triangle Park anchors a concentration of global firms including IBM, Cisco, Lenovo, and Red Hat, alongside fast-growing players like Pendo, Epic Games, and PrecisionHawk.

- The region’s three Tier-1 universities—Duke University, UNC-Chapel Hill, and NC State—feed a steady stream of highly skilled graduates into the workforce.

- Over 53% of adults in the metro hold a bachelor’s degree, one of the highest rates in the U.S.

CBRE notes that Raleigh-Durham continues to pair exceptional talent density with affordable operating costs. While the Bay Area remains the global epicenter for AI development, the Triangle’s mix of research institutions, moderate cost of living, and expanding venture ecosystem has made it a preferred destination for tech relocations and expansions.

Surprising Comparisons with Other Cities

One of the more striking insights from CBRE’s 2025 Scoring Tech Talent report is just how well Raleigh-Durham competes with larger, global tech hubs. Despite being far smaller in size than metros like San Francisco, New York, or Seattle, the Triangle continues to outperform on value, balance, and sustainability.

- Talent Quality Without the Price Tag: Raleigh-Durham ranks among the top markets for educational attainment—more than half of adults hold a bachelor’s degree—yet average tech wages and operating costs remain far below those of the Bay Area or New York. A 500-person tech firm can operate here for tens of millions less per year, freeing up resources for expansion and innovation.

- Innovation Density on Par with Major Hubs: The region’s concentration of research universities and major employers (like IBM, Cisco, Lenovo, and Red Hat) has created an innovation ecosystem rivaling far larger markets, particularly in applied AI, software engineering, and biotech.

- Affordability and Quality of Life: Unlike Austin or Seattle—both facing steep housing costs and infrastructure strain—Raleigh-Durham offers lower housing costs, shorter commutes, and stronger population inflows, all of which support steady housing demand and retail spending.

- Balanced Growth, Not Boom-and-Bust: Where other cities swing between tech surges and corrections, the Triangle’s growth is measured, diversified, and durable, supported by education, healthcare, and life sciences in addition to technology.

In short, Raleigh-Durham delivers the innovation output of a top-five tech hub at mid-market costs and with far greater long-term stability—a combination that makes it especially attractive to both employers and real estate investors.

What This Means for Investors

Every investment must be underwritten individually, with attention to asset condition, tenant mix, and local submarket dynamics. But as CBRE’s data shows, markets anchored by durable economic drivers—like tech employment and education—tend to mitigate downside risk and sustain long-term value creation.

At NC Capital Group, we focus on precisely these kinds of environments: economically vibrant metros where workforce housing and essential retail centers can serve the people fueling the next wave of growth.

Eddie Coleman, CCIM, is the Principal Investment Officer at NC Capital Group. With over 40 years of experience in Commercial Real Estate in North Carolina and South Carolina, his experience spans multifamily, retail, office, historic adaptation, etc. In addition to advising clients and brokering transactions, he has extensive knowledge of North Carolina through experience in corporate site acquisition, development, capitalization, HUD financing, etc. He holds the prestigious Certified Commercial Investment Member (CCIM) designation.