News & Information

-

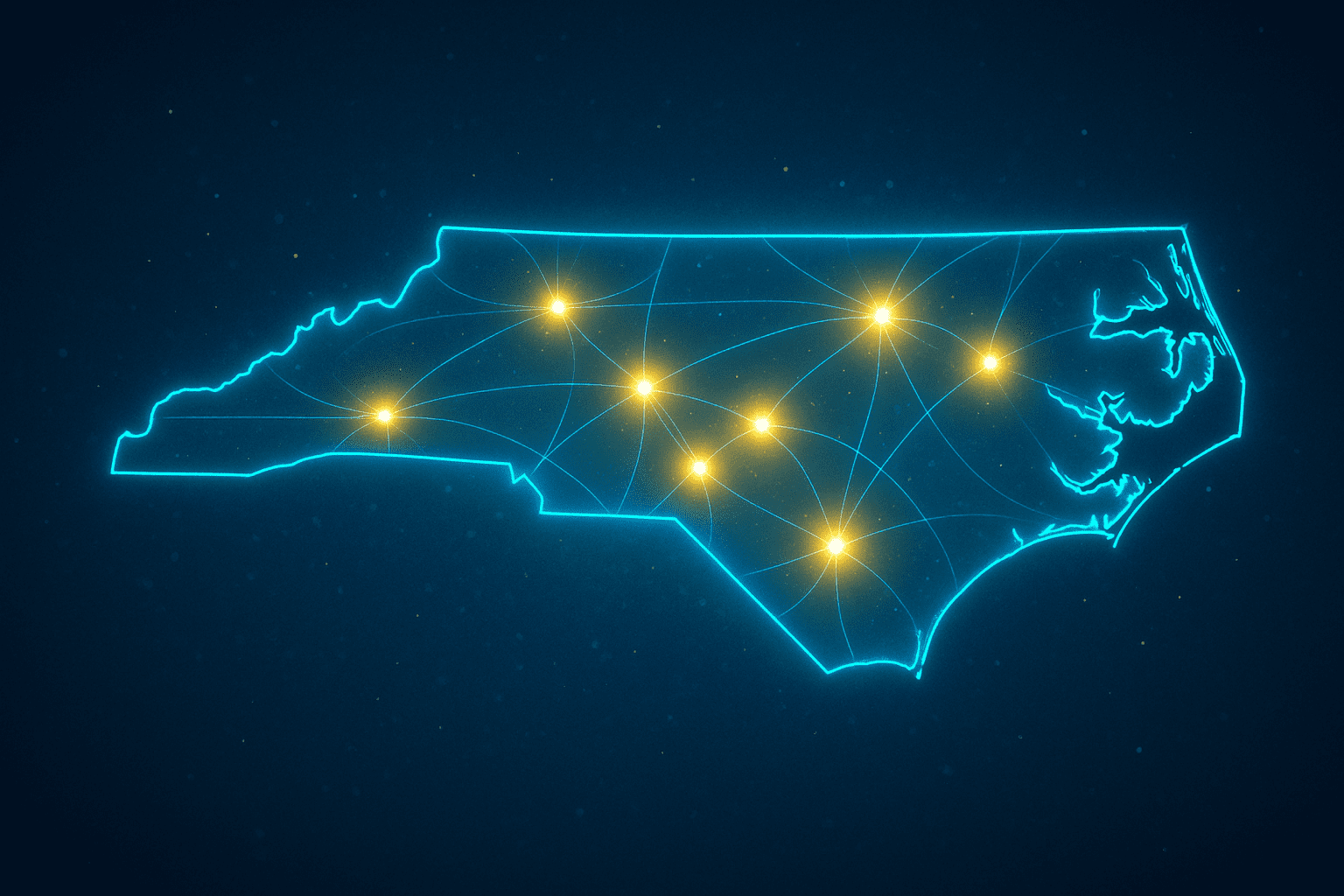

Fintech Expansion Fuels Charlotte’s Growth — SoFi Adds 225 High-Paying Jobs

SoFi Technologies, a leading digital finance platform, has announced plans to expand its Charlotte operations, adding 225 new jobs with an average salary of $108,000. The company will invest $3 million in the project, supported by a Job Development Investment Grant (JDIG) approved by the state’s Economic Investment Committee. Over the next twelve years, the…

-

Walmart’s New Fulfillment Center Strengthens the Charlotte–Gaston Growth Corridor

Walmart’s decision to invest $300 million in a state-of-the-art, 1.2 million-square-foot fulfillment center in Kings Mountain, Gaston County marks another milestone for North Carolina’s thriving economy. The project will create 300 new jobs and inject more than $20 million in annual payroll into the region once operations begin in 2027. For the Charlotte metropolitan area—and…

-

North Carolina’s Strong Economy Continues to Support Real Estate Investment Potential

When WalletHub released its 2025 Best & Worst State Economies report, North Carolina once again stood out — ranking #6 in the nation. That’s up from #8 last year. For investors, this matters: a healthy, growing state economy is one of the strongest foundations for consistent, secure real estate returns. A Data-Driven Look at Economic…

-

Misconception: Real Estate Income Is Taxed Like a Paycheck

It’s not what you earn, it’s what you keep. Many investors assume that all income is taxed the same — whether it’s from a paycheck, bonds, or real estate. But that misconception can lead to missed opportunities. Real estate, especially when held passively through a syndication or fund, is structured to let investors keep more…

-

Myth: You Have to Be a Real Estate Pro. Reality: You Just Need the Right Team.

Many investors hesitate to step into real estate because they think it’s only for industry insiders — people who can analyze deals, negotiate financing, and manage properties. In reality, you don’t need to be an expert to invest like one. You just need the right team. (See 6 Myths About Passive Real Estate Investing) Myth…

-

Real Estate Isn’t Liquid — and That’s a Good Thing

The Myth of Liquidity Above All Many investors have been taught that liquidity equals safety. The ability to buy or sell with a click feels comforting—especially in a world of instant information and market updates. Stocks, mutual funds, and ETFs can be sold in seconds, which seems like an advantage. But liquidity comes at a…

-

Debunking the Risk Myth: How Real Estate Brings Predictability to Portfolios

All investments carry risk, but stabilized real estate can offer lower volatility and more predictability than the stock market—especially in essential asset classes like housing and grocery-anchored retail. (See 6 Myths About Passive Real Estate Investing) Perception vs. Reality Many investors hesitate to add real estate to their portfolios because they’ve heard it’s risky. After…

-

Earn Like an Owner—Without Being a Landlord: The Passive Real Estate Advantage

Many professionals love the idea of real estate income but hate the idea of managing tenants, fixing toilets, or getting late-night calls about a leaky faucet. It’s one of the most common misconceptions about real estate investing: that to benefit from it, you have to be a landlord. That’s simply not true. Today’s real estate…