Author: Doug Kline

-

Passive Real Estate Investing Explained: LP Ownership, Cash Flow, and Exit

For many professionals, traditional portfolios dominated by stocks and bonds eventually feel incomplete. Market volatility, correlation risk, and limited income control tend to surface at exactly the wrong stage of life—when predictability matters more than headlines. Passive real estate investing addresses that gap by offering direct ownership of income-producing assets without the operational burden of…

-

The Pros and Cons of Passive Real Estate Investing for Long-Term Wealth Builders

As investors progress in their careers and accumulate capital, many begin to question whether a traditional portfolio of stocks and bonds is sufficient on its own. Volatility, sequence-of-returns risk, and tax inefficiency often become more noticeable—especially for high earners and professionals approaching retirement. This is typically where passive real estate investing enters the conversation. Not…

-

What Is a General Partner in Passive Real Estate Investing?

When you invest passively in a real estate deal, someone has to do the actual work. That role belongs to the General Partner (GP). A General Partner is the party responsible for finding, acquiring, financing, operating, and ultimately exiting a real estate investment. Limited Partners provide the capital, General Partners provide the expertise, execution, and…

-

What Is a Limited Partner? A Simple Guide to Passive Real Estate Ownership

For many professionals, real estate is attractive—but the reality of managing it is not. Tenants, maintenance calls, leasing decisions, and constant oversight don’t fit well with a full-time career or an active retirement plan. That’s where being a Limited Partner (LP) comes in. A Limited Partner is a way to own real estate passively, alongside…

-

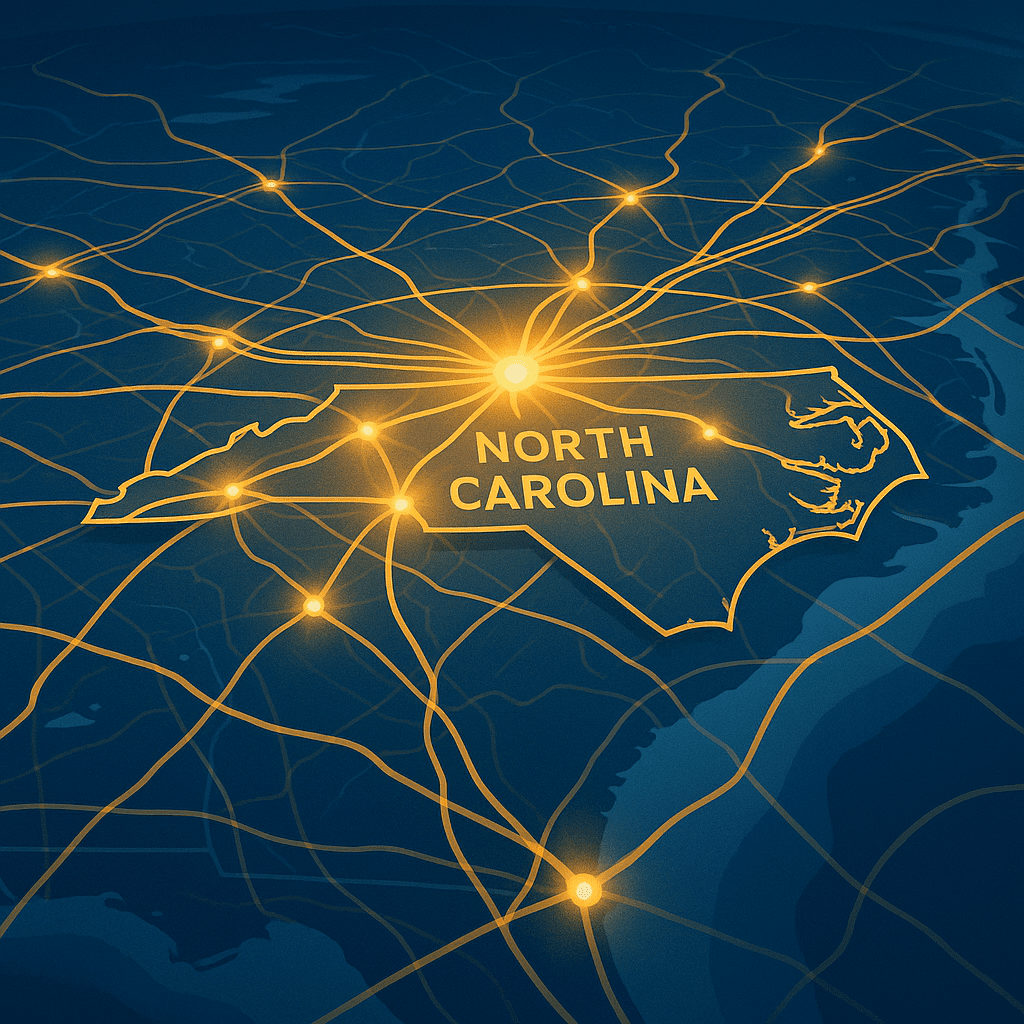

Population In-Migration and Real Estate Investing in North Carolina

Population growth is not abstract. It is households choosing where to live, work, and spend money. For real estate investors, that choice matters because it drives demand for housing, retail, and local services. North Carolina continues to attract inbound households at a national scale. Multiple independent datasets confirm this. We track these sources closely because…

-

What the U-Haul Migration Report Measures, How It’s Calculated, and What It Means

See the U-Haul migration data here. What U-Haul Measures U-Haul migration data is based exclusively on one-way U-Haul rentals (trucks, trailers, and U-Box containers) in which equipment is picked up in one location and returned in another during a calendar year. The data reflects actual moving activity, not surveys, modeled estimates, or forecasts. We track…

-

Cash Flow, Growth, or Both? How to Choose the Right Real Estate Asset Class

Real estate is often described as a single asset class. In practice, it’s anything but. Multifamily housing, grocery-anchored retail, office, specialty assets—each behaves differently, carries different risks, and serves different investor goals. Choosing the right real estate asset class isn’t about finding the best investment. It’s about finding the right fit for what you’re trying…

-

6 Myths About Passive Real Estate Investing — and the Truth Behind Them

Many investors hesitate to add real estate to their portfolios because of long-held misconceptions. At NC Capital Group, we hear them all the time — and we see how these myths can keep people from discovering one of the most reliable paths to long-term wealth. The truth is that passive real estate investing can offer…

-

$860 Million Ahold Delhaize Investment in Burlington NC

Ahold Delhaize USA — parent company of Food Lion, The GIANT Company, Hannaford, and Stop & Shop — has announced an $860 million investment to build a new state-of-the-art distribution and transportation hub in Burlington, North Carolina. The project is expected to create more than 500 jobs over time, with initial operations beginning in 2029…