The capital stack for a real estate investment project is a way of describing how the project is funded. It’s used as a high-level representation of the financial structure of the project, helping the stakeholders understand ownership, return, relative risk, and order of payment.

The capital for a real estate investment project can come from mulitple entities:

- private individuals

- investment entities

- banks

- etc

Each of these entities has different objectives regarding:

- Risk

- Return

- Control

- Taxes

- Engagement

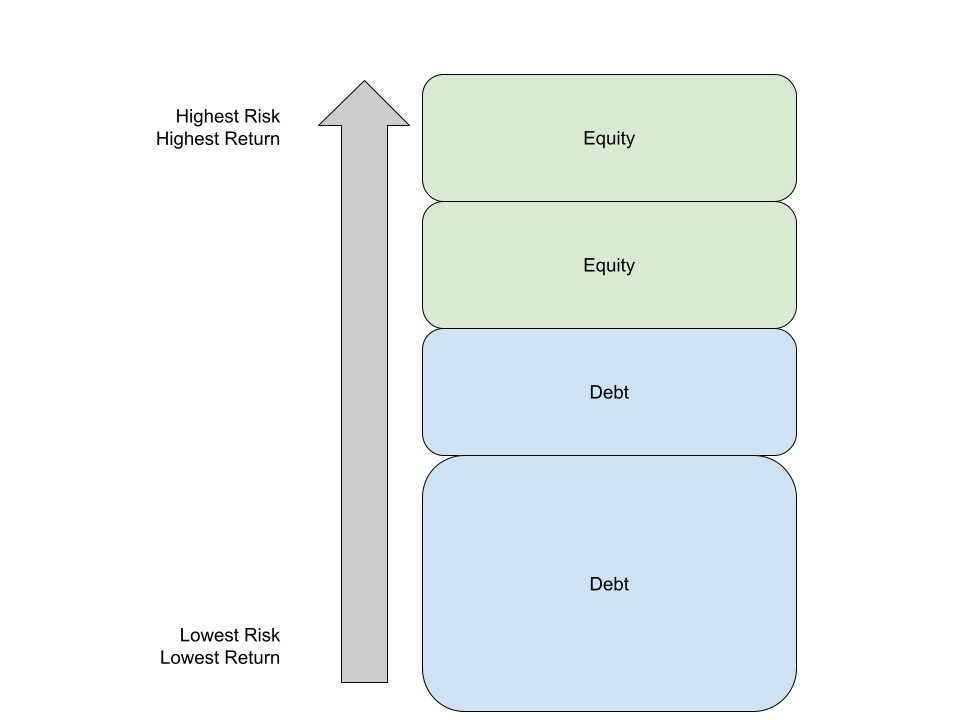

The capital for a project is conceptualized as a stack:

In the above stack, there are four levels. Each level has its own rights, priorities, and responsibilities in the project, and commensurate returns.

Generally, the lower in the stack, the more controls are in place to manage risk, and with lower risk investors require less return. The higher in the stack, the fewer controls for risk, and also the higher expected return.

Green levels represent real property ownership, i.e. Equity.

Blue levels represent loans, i.e., Debt.

Note that the terms Risk and Return represent a future that is unknown. Risk represents the negative (or positive) future events that could affect the project. Return represents positive (or negative) future financial benefits that could result from the project. Sometimes Risk and Return are represented as a percentage rate. Recognize that these are predictions, and may not be borne out as time passes.

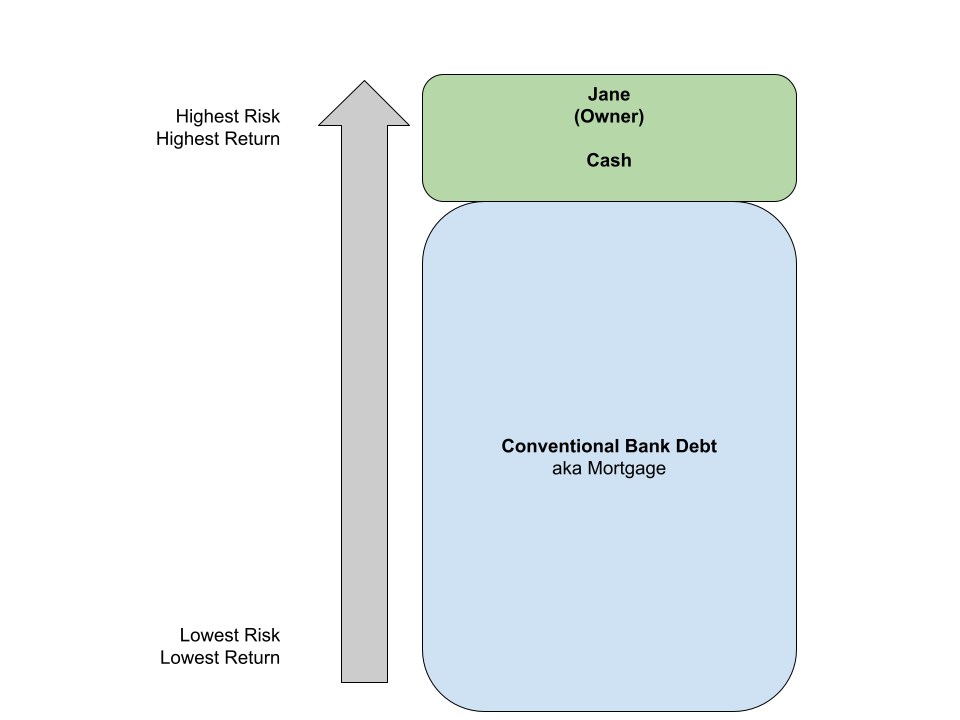

Example 1:

Suppose Jane buys a rental property with cash and carries a traditional fixed-rate mortgage. The capital stack for this project looks like this:

In this example, the bank holds a lien on the property, mitigating their risk. In compensation for their funds and their level risk, the mortgage lender is paid a fixed interest rate on the loan principal. In this example:

- the bank is on the bottom of the stack, representing the lowest risk and lowest return

- Jane is on the top of the stack, representing the highest risk and highest return

The bank:

- Does not get any income from the property

- Does not pay any expenses for the property

- Does not manage the property

- Is not responsible for any property taxes, i.e., has no ownership

- Is not responsible for any income taxes

- Receives no tax benefits for owning real property

- Receives no benefit from appreciation

- Receives no benefit from increased income

- Receives constant-level compensation based on the principal

Jane:

- Gets all income from the property

- Pays all expenses for the property

- Is responsible for managing (or arranging for management) the property

- Must pay property taxes, i.e., owns the property

- Must pay taxes on any profit

- Receives any tax benefits (deductions, depreciation, government incentives)

- Receives/loses any increase/decrease in property value

- Receives/loses any increase/decrease in income

- Receives/loses any increase/decrease in expenses

If Jane manages the project well in a beneficial economic environment, the tax benefits, appreciation, increased income, decreased expenses can create a high rate of return. However, if the project is poorly managed in a declining economic environment, her return could be low.

Note that the size of the block in no way represents an amount. Jane could be financing 100% of the purchase price, or 50%.

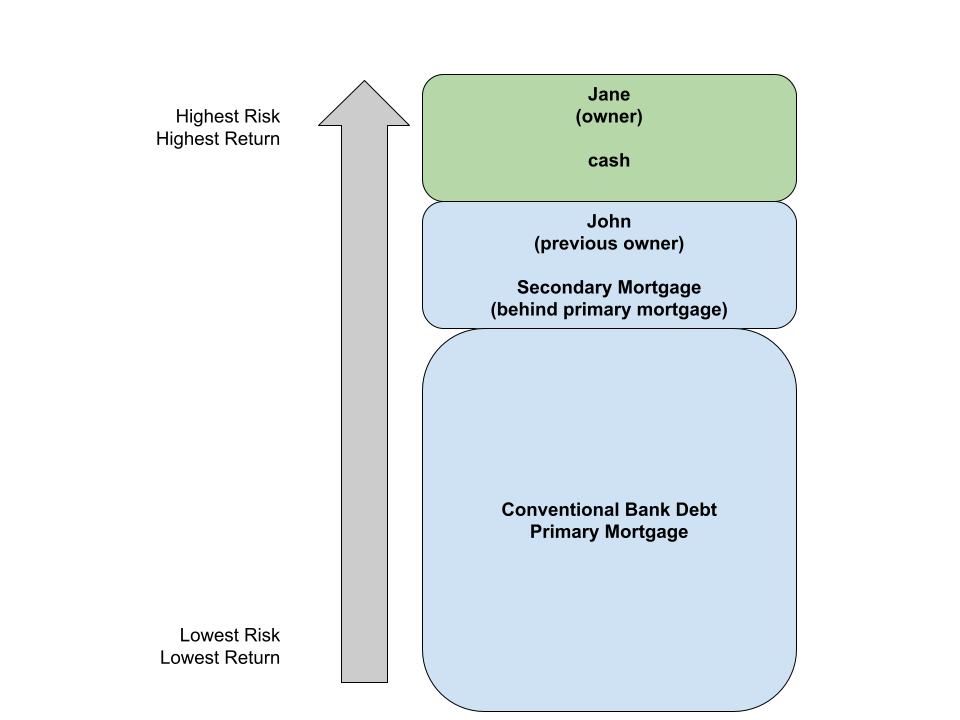

Example 2:

Suppose Jane buys a rental property as above, except that the previous owner is willing to hold a secondary mortgage on the property. The capital stack would look like:

In this example, the bank is said to be “in the first position”, ahead of the Secondary Mortgage. In other words, if Jane defaults, and there is not enough capital to pay off the mortgages, the Primary Mortgage would be paid first. Potentially, the second mortgage could be unpaid or partially paid. (The specific terms of each mortgage can vary.)

Because the bank would be paid ahead of John, their risk is lower. Because John’s risk is higher than the bank, he might require a higher interest rate than the bank.

As in the first example, Jane is the owner, and gets all benefits (and bears all responsibilities) of real property ownership. John and the bank are loan providers, and represent debt (blue blocks).

As above, the size of the block need not be related to any amount. The purchase price could be made of x% Jane’s cash, y% John’s mortgage, and z% bank mortgage, as long as x+y+z=100%. The terms of the mortgages can vary and are agreed upon between Jane and each lender.

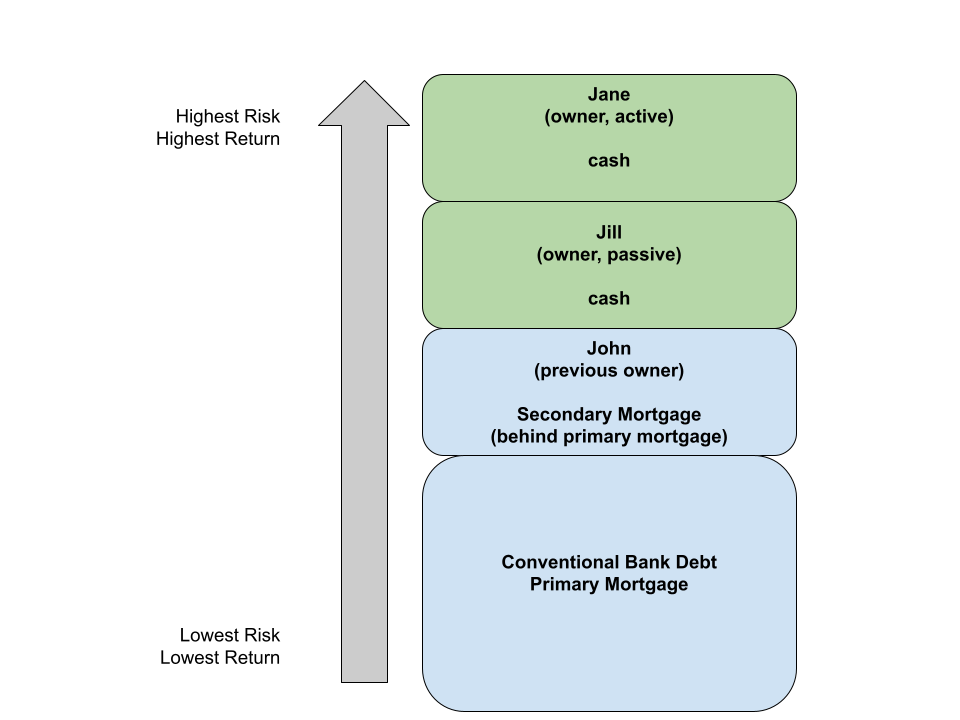

Example 3:

Suppose Jane wants to buy a particular 50-unit apartment complex, currently owned by John. She has a lender for the primary mortgage, and John is willing to carry a secondary mortgage. She also has an investor, Jill, who would like to own real property, but is unwilling to manage or work on the property.

In this example, the stack looks like:

The debt levels of the stack operate similarly to the previous example.

Both Jane and Jill are owners of the property, so their levels in the stack are green. However, Jane is the active member, which generally means that Jill is the “silent” partner. In other words, even though both of them own the property, Jane is the decision maker.

Of course, the exact terms would be spelled out in an agreement.

Jane and Jill must define and agree on terms for their agreement. Here are some of the items they need to address:

- Percentage ownership of the property

- Percentage distribution of profits

- Any “preferred” distributions (see discussion below)

- Compensation for management activities

- Future project events: sales, refinancing, etc.

- Dissolution mechanism

A knowledgeable, trusted attorney is critical in drafting an agreement.

Here is a possible set of terms. This is not legal or financial advice, merely an example to illustrate possibilities.

- Jill owns 60%, while Jane owns 40%

- Ongoing profits will be distributed according to ownership percentage

- Jill will charge 5% of rents for management of the property. It will be considered a before-profit expense for the investment.

- The property will be sold or refinanced in the year xxxx

- If one owner wishes to exit, the other has first rights to buy the property from the other at a fair market value

As mentioned above, this is not a complete set of terms, and should not be construed as good or bad, merely illustrative.

Furthermore, the example above should not be viewed as better or worse for Jane or Jill.

Ideally, both view the investment and the terms as personally beneficial. The terms should reflect their individual objectives, risk tolerances, and view of the future. Both Jane and Jill should consult with their real estate attorney(s), financial advisor(s), tax accountant(s), and other professionals.

Conclusion

The capital stack is a way to represent how a real estate investment project is being funded. Generally, higher in the stack means higher risk and higher reward. Equity and debt stack levels are generally delineated.

This article explained the concepts of the capital stack, and showed a few simple examples. The financial structure of projects can vary widely, with many stakeholders, each with their own set of terms. The capital stack is a high level representation of the stakeholders and their place in the financial structure of the project.