When most investors look at potential investments, their first question tends to be, “What’s the yield?” It’s a fair starting point — after all, yield represents immediate cash in your pocket.

But if you’re a high-earning professional building wealth over the long term, focusing only on annual yield is like judging a car solely by its cupholders. You might miss the real engine that drives wealth creation: the equity multiple.

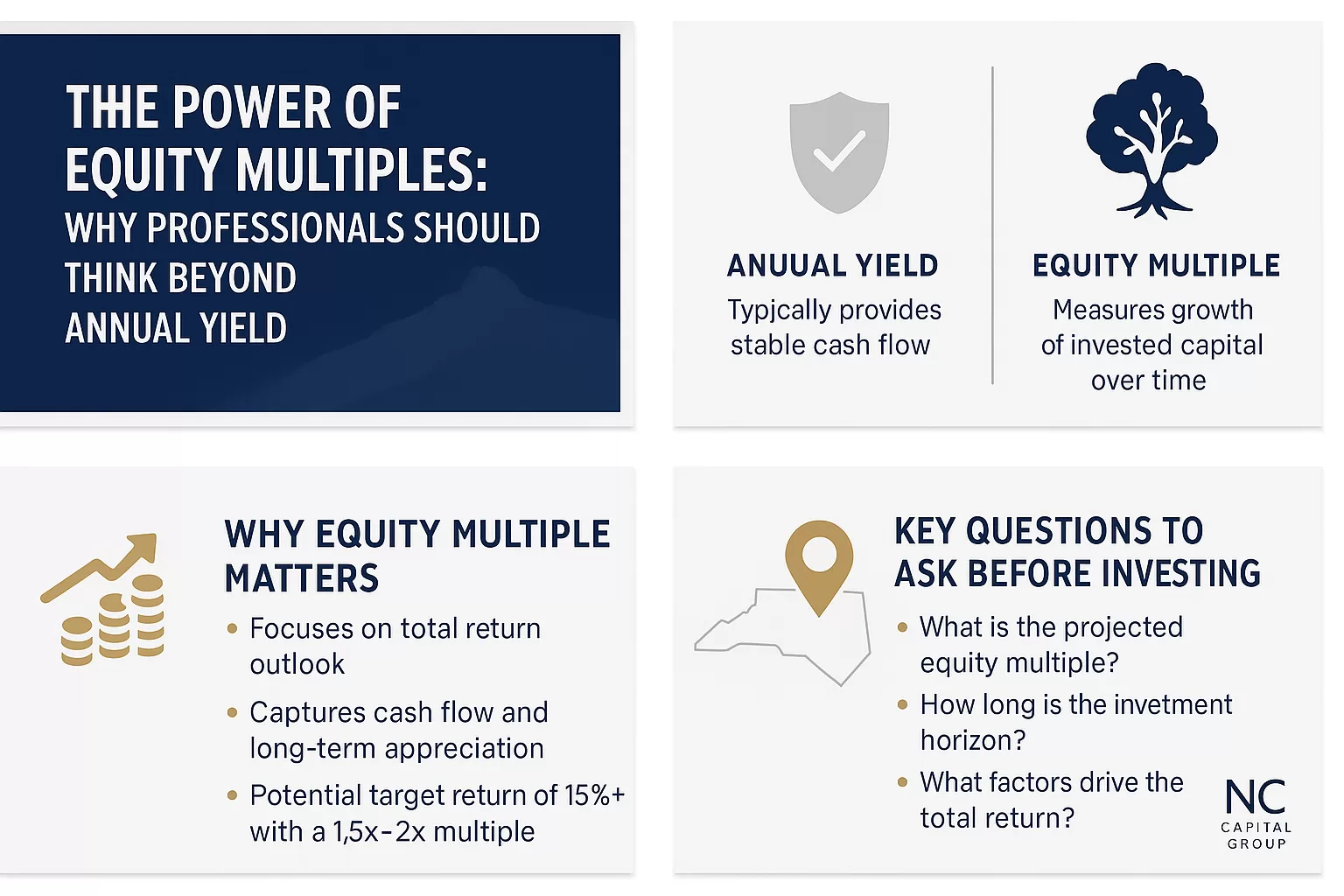

What Is an Equity Multiple? (And Why Should You Care?)

Simply put, the equity multiple measures how much you get back on your investment relative to your initial contribution. It’s your total return, not just your yearly income.

- If you invest $50,000 and receive back $100,000 at the end of the investment (including all cash flows and sale proceeds), your equity multiple is 2.0x.

- If you invest $50,000 and receive $75,000 total, your equity multiple is 1.5x.

It’s a cumulative view, showing not just what you earned each year, but how your money grew over the full investment period.

Why Professionals Should Think Beyond Yield

High-yield investments are great for current cash flow, but true wealth is built by growing your invested capital over time — ideally with tax advantages baked in.

Here’s why thinking about equity multiples matters:

- Compounding Happens Over the Hold Period:

Some of the most powerful real estate returns come at the end, when a property sells at a premium after years of operational improvements. - Yield Can Be Deceptively Flat:

A 6% annual yield sounds solid, but if the asset loses value or returns your capital without true appreciation, you’re treading water. - Equity Multiple Reflects True Total Return:

Professionals who understand both cash flow and backend gains are the ones who consistently outperform over a decade or longer.

A Quick Example: Yield vs. Equity Multiple

Imagine two investments:

| Investment A | Investment B | |

|---|---|---|

| Annual Yield | 7% | 5% |

| Equity Multiple | 1.2x | 1.8x |

| Hold Period | 5 years | 5 years |

- Investment A pays you nicely every year — but with minimal appreciation.

- Investment B pays slightly less each year, but at sale, you enjoy a significant profit on your original investment.

At the end of 5 years, Investment B leaves you far wealthier.

Annual yield made you feel good. Equity multiple made you rich.

Choosing Investments with Strong Equity Multiples

When evaluating passive real estate opportunities, here’s what to ask:

- What is the projected equity multiple?

- What assumptions drive that projection (rent growth, cap rate, etc.)?

- What percentage of total returns comes from cash flow vs. backend sale?

Smart sponsors design deals to balance steady income with long-term growth, targeting realistic multiples — often between 1.5x and 2.0x over a 5–7 year horizon.

The Bottom Line

Annual yield is a snapshot. Equity multiple is the full movie.

If you’re serious about building wealth — not just collecting checks — make equity multiples a primary lens when evaluating your next passive investment.

Because smart investing isn’t just about cash today. It’s about where your money can take you tomorrow.

Doug Kline, PhD, has held income properties in North Carolina for more than 20 years. He holds a North Carolina broker’s license, and is a member of the National Association of Realtors and the Triangle Real Estate Investors Association. He holds an MBA and a PhD in business. In addition to his real estate activities, Doug enjoyed a successful career in academia, achieving the rank of Full Professor in the Cameron School of Business at UNC Wilmington. He was honored with research and teaching awards, served as Director of the MS Computer Science and Information Systems program, and was awarded the endowed position Distinguished Professor of Information Systems.