Preferred return is sometimes used at one or more levels in the capital stack to create a prioritization on how profits are distributed. If one level of the stack has a preferred return, their overall return does not change, but their distributions have priority over other distributions.

In our article An Explanation of the Capital Stack, we covered how the funding of a real estate project can be represented in a stack.

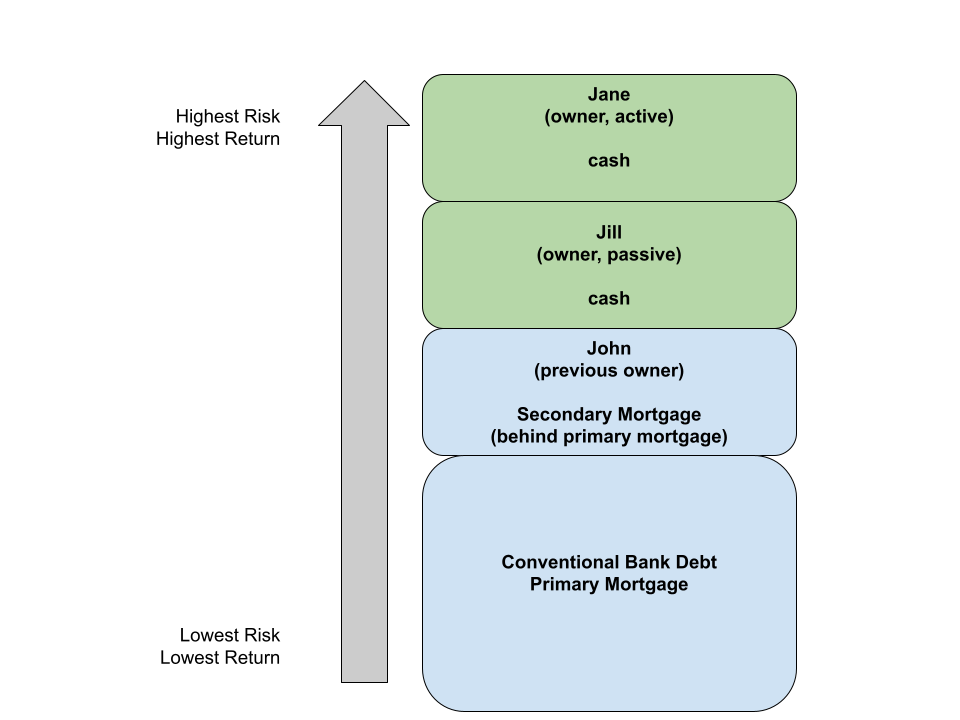

Below is the capital stack for the last example in that article. In that example, Jane is buying a multifamily property with Jill as a passive investor. John is the previous owner who is carrying back a secondary mortgage. There is a conventional primary mortgage.

We also gave a possible set of terms that might be specified for the project related to the capital stack above:

- Jill owns 60%, while Jane owns 40%

- Ongoing profits will be distributed according to ownership percentage

- Jill will charge 5% of rents for management of the property. It will be considered a before-profit expense for the investment.

- The property will be sold or refinanced in the year xxxx

- If one owner wishes to exit, the other has first rights to buy the property from the other at a fair market value

This is only an example. A knowledgeable, trusted attorney is critical in drafting an agreement.

Let’s assume Jane invested $100,000, and that there was a $10,000 profit at the end of the year. Here is how that profit would be distributed according to the terms above (no preferred return specified).

| item | Amount | reason |

| profit | $10,000 | Jane’s share: $4,000 Jill’s share: $6,000 |

| Jane 40% | $4,000 | 40% of profit |

| Jill 60% | $6,000 | 60% of profit |

In this case, the profits are distributed at the end of the year according to the ownership percentage.

Let’s change the terms to include a preferred return for Jane of 7%.

Here is how the $10,000 profit at the end of the year would be distributed, with the 7% preferred return.

| item | Amount | reason |

| profit | $10,000 | Jane’s share: $4,000 Jill’s share: $6,000 |

| Jane 40% | $7000 | 7% on her $100,000 |

| Jill 60% | $3000 | remaining profit |

But wait, isn’t Jill entitled to $6000? Her 60% share of the $10,000 profit?

And didn’t Jane get too much? She was entitled to $4000. Her 40% share of the $10,000 profit?

Yes, the share of the profit still stands, and is still owed. When the profit is distributed is what the preferred affects.

After the distribution this year, here is how the accounts would stand:

| account | amount | reason |

| Jane 40% | -$3000 | $4000 owed profit, minus $7000 payout |

| Jill 60% | $3000 | $6000 owed profit, minus $3000 payout |

NOTE: Preferred returns only mean anything when the profit is limited.

Suppose the profit for the year was $40,000? Here’s how it would be distributed:

| item | amount | reason |

| profit | $40,000 | Jane’s share: $16,000 Jill’s share: $24,000 |

| Jane 40% | $7000 | 7% preferred on her $100,000 |

| Jane 40% | $9000 | remaining 40% of $40,000 profit $16,000 minus $7000 |

| Jill 60% | $24,000 | 60% of $40,000 profit |

And here is how the accounts would stand after the distribution:

| account | amount | reason |

| Jane | $0 | $16,000 owed profit minus $16,000 payout |

| Jill | $0 | $24,000 owed profit minus $24,000 payout |

So, why would a capital stack include a preferred return?

In the example above, the preferred return assures Jane that she will get her share of the returns earlier than other equity parts of the capital stack.

Summary

A preferred return can be specified to an equity portion of a capital stack. It is commonly offered to passive investment levels in a capital stack. Preferred return may or may not be included in the terms for a capital stack.

Doug Kline, PhD, has held income properties in North Carolina for more than 20 years. He holds a North Carolina broker’s license, and is a member of the National Association of Realtors and the Triangle Real Estate Investors Association. A lifelong learner, he holds an MBA and a PhD in business, and continues his education by attending meetings of the Society of Exchange Counselors and the National Counsel of Exchangors. In addition to his extensive real estate activities, Doug enjoyed a successful career in academia, achieving the rank of Full Professor in the Cameron School of Business at UNC Wilmington. He was honored with research and teaching awards, served as Director of the MS Computer Science and Information Systems program, and was awarded the endowed position Distinguished Professor of Information Systems.